Bitcoin will continue to see tremendous growth and innovation over the coming years. The next time you hear Bitcoin is dead, take a step back and think twice, because it will likely be a great time to buy.

Bitcoin just hit an all time high price of $1220 which is roughly $45 above previous highs from 2013. But how? According to the media and so-called financial experts Bitcoin died three years ago after it crashed to less than $200. It was labeled a 'tulip' frenzy and Ponzi scheme. Outsiders didn't only dismiss it as a joke, they were often hostile toward it. Paul Krugman famously wrote a blog post in 2013 with a tantalizing title, "Bitcoin Is Evil" . Other mainstream media outlets wrote hit pieces with titles such as "The Exact Date for Bitcoin's Final Crash to $0.00" or "Bitcoin Will Crash to $10 By Mid 2014". And I get it, after Mt. Gox was hacked of $450 million dollars, it was extremely easy to lose sight of what made Bitcoin so exciting. It was easy to assume that because the price was crashing, Bitcoin was dead. The truth however revealed something entirely different. If you took a step back, and looked at bitcoin without any form of bias, it was flourishing.

QUALITATIVE GROWTH

After the bubble in 2013 that took Bitcoin from $10 to $1200, the ecosystem saw tremendous growth despite the declining price. Large name retailers such as Dell, Expedia, and even Microsoft started accepting BTC as a form of payment. World renown technologists and investors such as Marc Andreessen and Richard Branson actively endorsed and praised the technology as being the next step in the evolution of money. Even the Chairmen of the Federal Reserve, Ben Bernanke was quoted saying "[Virtual Currencies] may hold long-term promise, particularly if the innovations promote a faster, more secure and more efficient payment system." These are all people who saw the big picture in the midst of extreme adversity. Pandora's box had been opened, and no one could stop it.

QUANTITATIVE GROWTH 2013-2014

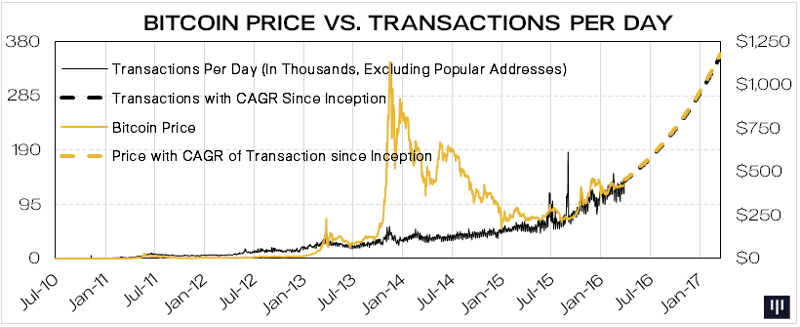

Lets get into the numbers. During the price decline in 2014, total Bitcoin trading volume went from $15 billion to $25 billion dollars, an increase of 57%. Venture Capital went from $96 million to $335 million, an increase of 342%. The number of countries with VC investment in Bitcoin companies went from 8 to 18, an increase of 125%. The number of Bitcoin wallets went from 2 million to 8 million an increase of 400%. The number of transactions on the network went from 54,000 to over 150,000 per day, an increase of nearly 300%. Merchants adopting Bitcoin as a means of payment went from 14,000 to 45,000, an increase of over 200%. And last but not least, mining power behind the network went from 10,000 TH/s to 300,000 TH/s, an increase of over 30,000%. The question remains, why didn't any of this get covered or talked about? And I think the answer is complex, but to simplify, Bitcoin made people uncomfortable. It made people question the definition of money itself. Could a new form of currency exist outside of central control and governments? When most people ask themselves this question, they naturally revert to a comfortable state by laughing at it and calling it a joke. However, the reality was that a silent revolution was taking place behind the scenes.

WHERE ARE WE NOW?

As of right now, the price of Bitcoin has never been higher. Bitcoin now transacts 1.8 billion dollars per week on its network with no signs of slowing down and all of the growth metrics mentioned in the paragraph above have seen large increases since 2014. There are several reasons why one should remain optimistic about Bitcoin into the near future.

1) Bitcoin's protocol went through a halving in July of 2016. This happens every four years and means that new coins being created by the network gets cut in half until there are none left (reduced supply).

2) As the PBOC continues to devalue the Yuan, Chinese citizens look for ways to hedge out of their currency. This will continue to lead to a large increase in demand for BTC in China.

3) Bitcoin is seen as digital gold and a hedge against the world. During the course of its short history, things like the Brexit and Greek debt crisis have led to huge spikes in the price and demand for BTC. With a lot of questions going around about the future of the European Union and the geopolitical uncertainty that exists because of the Trump presidency, Bitcoin will likely flourish.

4) Hyperinflation: Bitcoin is a way for citizens that live in country's experiencing hyperinflation to opt out. For example, Venezuelan Bitcoin transactional volume is up 1200% over the last six months. They are even using the currency to buy groceries through Amazon vendors because no one will take the Bolivar as a form of payment since it's basically worthless.

5) Scaling: There are several exciting new layers being built on top of the Bitcoin protocol. The lightning network which should go live this year will enable up to 1 billion settled transactions per second at next to no cost. To put that into perspective, Visa's capacity is currently 30,000 transactions per second and it's next to impossible to send tiny amounts of money because it's too expensive. Another scaling product is called RSK Rootstock. This is a smart contract platform that will expand Bitcoin’s capabilities far beyond what they are now.

Not only will you be able to send money across the network, with Rootstock you will be able to implement an autonomous instruction manual into each transaction.

CONCLUSION

Bitcoin will continue to see tremendous growth and innovation over the coming years. It's important to remember, Bitcoin is something different to everyone and its always changing and evolving. To some, it alleviates the pain of transferring money overseas. To others, it's a hedge against their corrupt and hyperinflationary central banks and governments. And to the four billion people in the world who are either not banked or underbanked, it's a way to gain global and equal access. I hope you will continue to read and learn about Bitcoin, as it may be a driving force for change in the coming years. And remember, the next time you hear Bitcoin is dead, take a step back and think twice, because it will likely be a great time to buy.